High Demand but Fragile Foundations — The U.S. Study Abroad Market in 2026

Share

Demand Is High — But Conversions Are Fragile

Indicators of student interest in the U.S. remain strong:

- Google search data shows rising queries for “study in USA” from Asia and Africa.

- Agents report strong application pipelines.

- Universities continue to attract high volumes of international offers.

But interest doesn’t equal enrolment. What matters is conversion: how many applicants secure visas and arrive on campus. And here, the U.S. system is showing cracks.

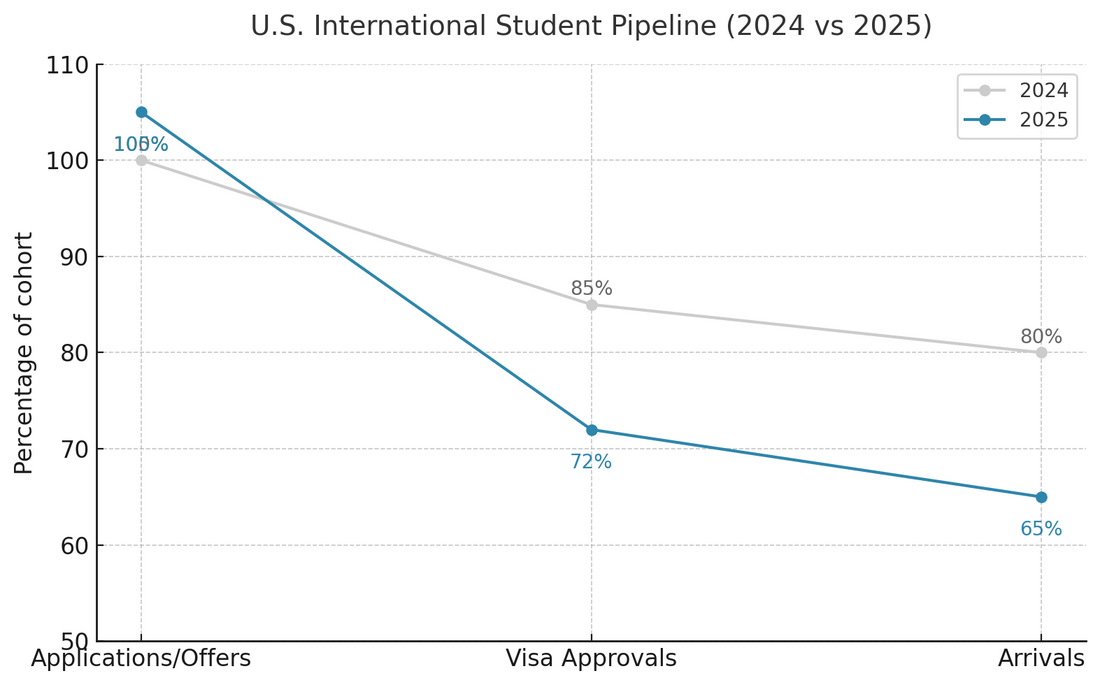

The Student Journey Funnel

| Stage | 2024 Level | 2025 Level | Change |

|---|---|---|---|

| Applications / Offers | 100% | 105% | +5% |

| Visa Approvals (F-1) | 85% | 72% | –13 pts |

| Actual Arrivals on Campus | 80% | 65% | –15 pts |

(Illustrative data from U.S. State Dept and sector reporting, 2024–25)

This shows the gap: interest remains high, but fewer students are making it through to arrival because of visa delays, consular appointment freezes, and policy uncertainty.

Why the Fragility Matters

- Financial risk: A 10–15% enrolment dip wipes out hundreds of millions in tuition revenue.

- Research impact: Graduate programs rely on international PhDs to staff labs and teaching.

- Reputational damage: Students who face hurdles don’t just defer—they often switch permanently to Canada, Australia, or Asia.

The Global Benchmark

- Canada: Offers the Student Direct Stream with faster processing.

- Australia: Raised intake levels to 295,000, tied to housing.

- New Zealand: Boosted work rights to 25 hours/week.

Compared with this, the U.S. looks bureaucratic and unpredictable.

What Needs to Change

If America wants to convert interest into enrolments, it must:

- Expand consular staffing during peak student seasons.

- Guarantee visa appointment slots for students.

- Publish transparent service-level targets for F-1 visa processing.

- Reaffirm post-study work pathways to reassure students about ROI.

Conclusion

The U.S. still commands unmatched prestige in global higher education. But prestige alone won’t sustain growth. Students are choosing destinations where rules are stable, visas are fast, and ROI is clear. Unless the U.S. fixes the operational side of international education, it risks losing a generation of students to more nimble competitors.